Get personalized financial advice to help you achieve your goals in the shortest time.

The difference between having a trusted partner by your side committed to transforming your financial dreams into reality. Your future starts now, and we're here to lead you toward a prosperous tomorrow.

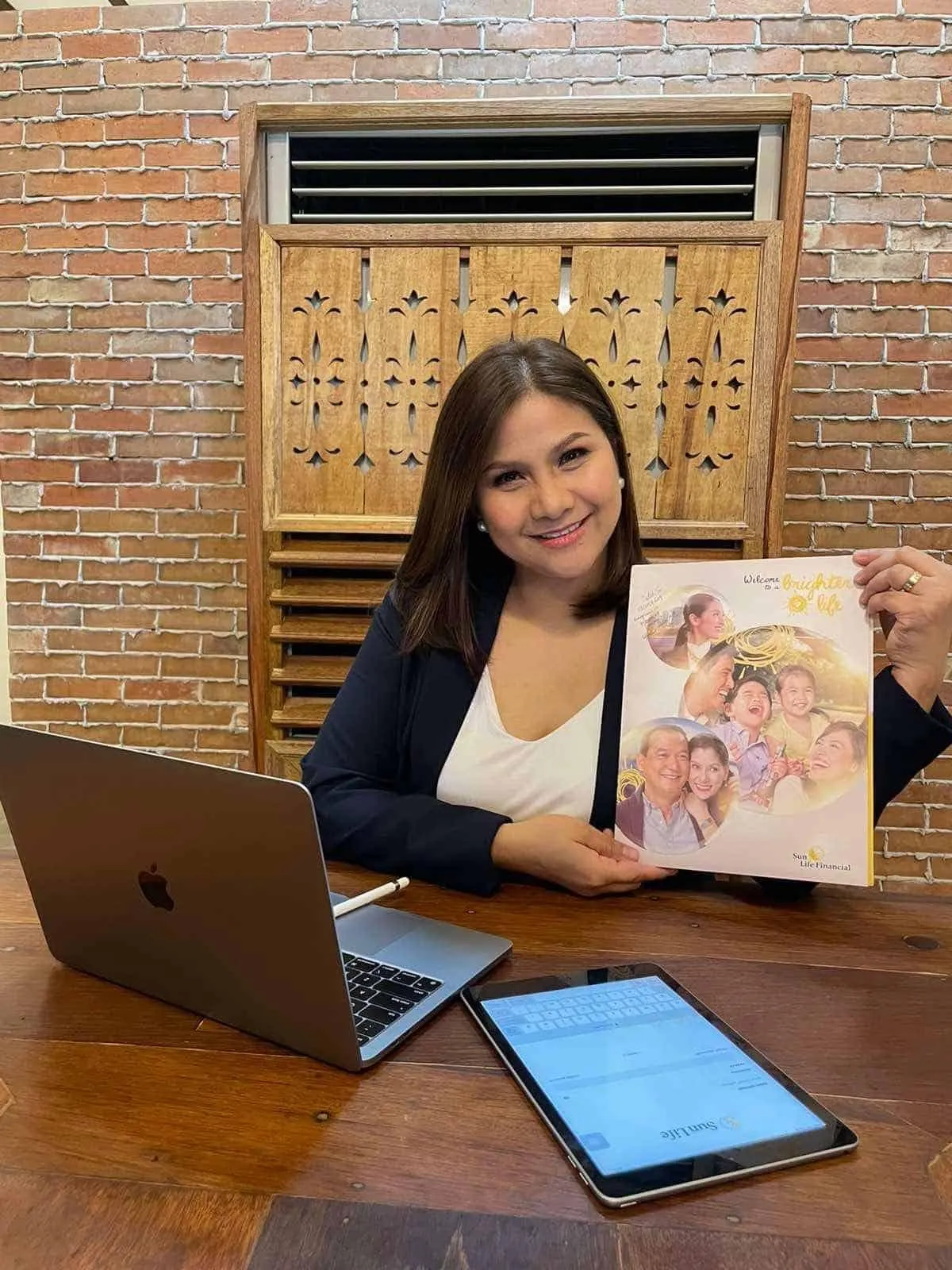

Hi, I am Cyra Vallente

Your Lifelong Partner in the area of Financial Planning. Your Guide to Financial Security and Prosperity

As a distinguished Financial Advisor with Sun Life of Canada (Philippines), Inc., I've dedicated my career to helping individuals, families, and business owners navigate the complexities of financial planning to achieve their dreams. My journey, rooted in over a decade of Human Resources experience in various local and global companies and magnified by my role at Sun Life, has been driven by a passion for understanding and addressing the unique needs of people from all walks of life.

Transparency, integrity, and trust form the foundation of my relationships with clients. I pride myself on providing objective advice, staying current with market trends, and adapting our strategies to the evolving financial landscape.

I would be glad to serve you and get people you care be protected while putting you in the best position to achieve your goals.

Services Offered

Comprehensive Financial Planning Services Tailored for You

Financial Planning

Our expert advisor meticulously craft personalized financial plans that encompass your short and long-term goals. From budgeting and debt management to retirement and estate planning, we ensure a roadmap for your financial success. Tailored blueprints for your financial journey, ensuring each step aligns with your aspirations.

Individual Life Insurance

Mitigate risks and protect your assets with our insurance guidance. We analyze your unique needs and recommend the right coverage to shield you from unexpected events. Peace of mind through comprehensive insurance solutions, safeguarding what matters most. Protect what matters most with policies that offer peace of mind and security for your loved ones.

Group Insurance

Enhance the benefits offered by your business with comprehensive group insurance solutions. From health to life insurance plans, ensure your employees are well taken care of, boosting morale and attracting top talent to your organization.

Education Funding

Prepare for your children's education expenses with effective funding strategies. We help you explore savings plans and investment options tailored to your educational goals. Empowering your children's futures by planning for their educational needs.

Client Testimonials

★ ★ ★ ★ ★

“Have been blessed to have Cyra as my Financial Advisor. She's very patient with me and takes time to understand my needs and recommends the right products for my situation. Highly recommended!”

Apple Pablo

Workforce Planner

★ ★ ★ ★ ★

“For your Insurance and Financial Advisory needs, go with Cyra and you won't go wrong.

She just takes care of you and helps you set financial goals and match them with the right plan.

She gives such valuable advice in finances and life in general.

Liza Caparas

Accountant

★ ★ ★ ★ ★

“So happy to have Cyra as my Financial Advisor! She helped us better secure our future with the right plans. Just perfect for our needs. I look forward to achieving our family's goals with her as our financial coach. Super recommended!

Peter Andrew Ibe

Entrepreneur

★ ★ ★ ★ ★

When my husband and I first considered life insurance, we were completely lost. Then, we met Cyra. She walked us through every step, explaining our options in a way we could understand. Thanks to Cyra, we now have peace of mind knowing our family is protected. She's not just our advisor; she's become a part of our family.

Mary Anne Pagcu

Workforce Analyst

Take that monumental shift to a Brighter Financial Journey ahead.

No better time than now.

Click the button below to schedule your FREE consultation with an expert Financial Advisor.

Why Work with Cyra?

Deep Understanding of Client Needs

With a rich background in HR and financial planning, I offer a unique perspective that combines empathy with expertise.

Personalized Financial Solutions

From securing your family's future with life insurance to planning for your retirement, every solution is tailored to fit your life.

A Commitment to Your Success

Your goals are my goals. You will tell me your situation, your goals, and what's important to you, and I will share how we can achieve them together.

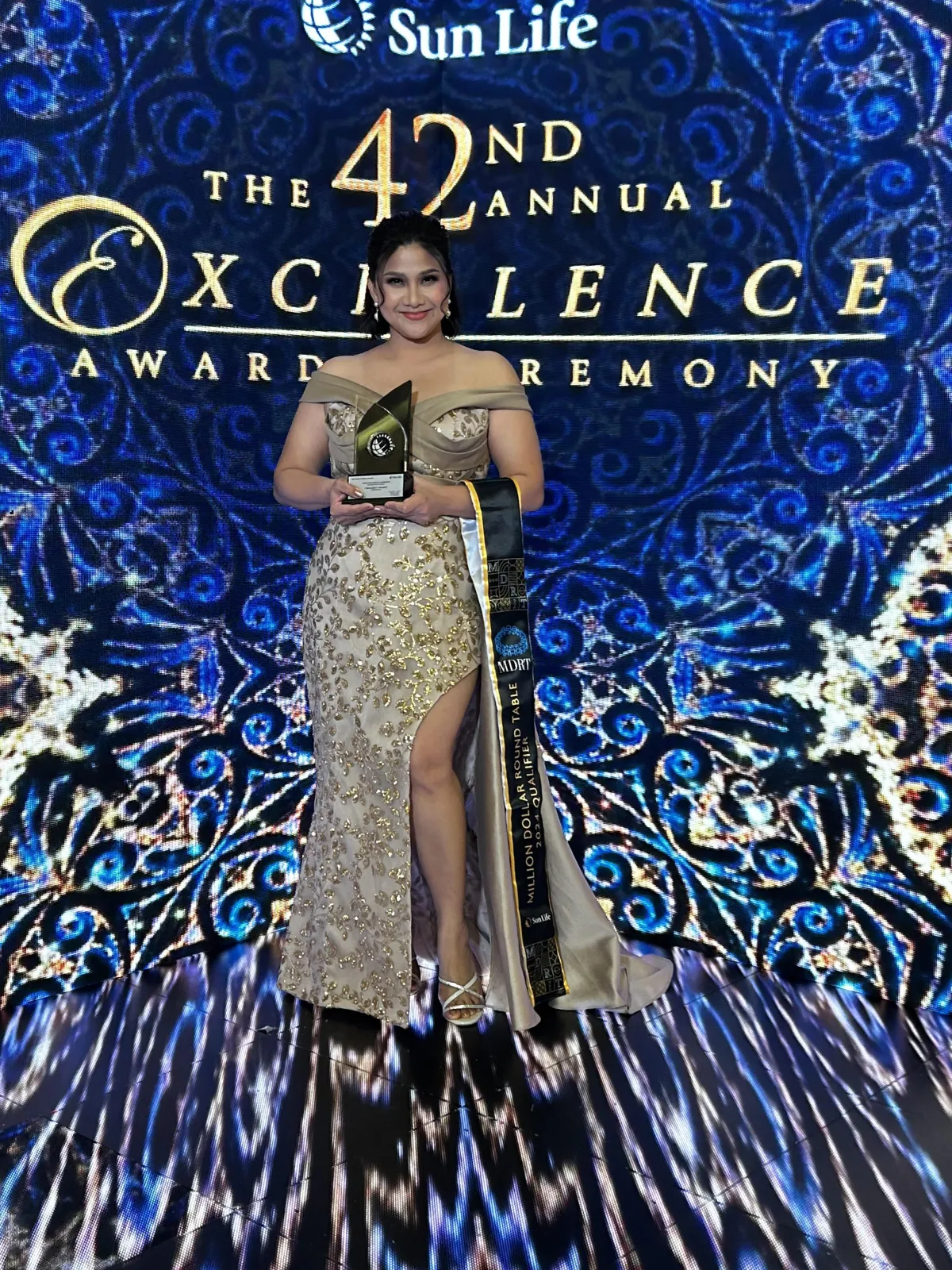

Proven Track Record

It gives you comfort to work with someone you can trust and my awards and recognitions are a testament of my passion to help a multitude of people in their financial journey.

These awards and recognitions are testaments of Cyra's passion to serve others and being the best at what she does.

Million Dollar Round Table (MDRT) Member 2024

Multiple Top Advisor of the Month

Multi-Year Macaulay Club Elite Advisor

Advisor of the Year (2021)

3-time LIMRA International Quality Awardee

Medallion Awardee - Presidents Month 2022, 2023

Group life League of Champion - Summer Campaign 2021

Medallion Awardee - Summer and August Champs 2019-2022

Advisor Match Branch Representative (2021)

Certified Investment Solicitor 2020

Rookie Advisor of the Year 2019

How to Get Started

1. Initial Meeting

In the first meeting, we will talk about your current situation, your financial goals and what’s important to you. I will ask you the right questions and listen to your answers carefully. With this, I can provide instant answers to your questions and general information about your goals. We will, then, agree on a schedule for a meeting via Zoom so we can discuss further all your financial needs in detail and provide you my personalized recommendations

2. In-depth Consultation

In the second meeting, I will ask for your personal and financial information so I can create a custom plan for provision, protection, asset accumulation, and all other financial considerations for you. After then, I will find the correct products to help you achieve your objectives

3. Implementation of Financial Plan

After you have agreed on the best products to achieve your financial goals, it’s time for the realization of your wealth planning. I will help you in completing the entire implementation process in a timely manner. I will take care of the whole administrative work and you will be assured of my complete transparency throughout the process, as I keep you informed and discuss every step with you.

IMPORTANT NOTE: My service is 100% FREE for you until closing. This is because I get compensated solely for SUCCESSES.

Only after you have chosen a product that you are truly happy with, and has been approved by the financial institution, will I receive a commission from the financial institution, at no extra cost to you.

Frequently Asked Questions:

What is individual life insurance, and how does it differ from group life insurance?

Individual life insurance is a policy taken out by an individual to provide financial protection to their beneficiaries in case of their untimely death or terminal illness. Unlike group life insurance, which covers multiple individuals under a single policy and is often provided by employers, individual life insurance is customizable, offering tailored coverage to meet specific personal and family needs.

Who should consider getting individual life insurance?

Anyone looking to ensure their family's financial security and peace of mind should consider individual life insurance. It's particularly important for primary earners, parents, homeowners, business owners, and those with significant debts or financial obligations. It's also a valuable tool for anyone interested in wealth accumulation, estate planning, and leaving a legacy.

What are the main types of individual life insurance available?

The two main types are term life insurance, which provides coverage for a specific period, and permanent life insurance, which offers lifelong coverage and typically includes a cash value component. Within these categories, there are various policies tailored to different needs, including whole life, universal life, and variable life insurance.

Can I customize my individual life insurance policy?

Yes, one of the key advantages of individual life insurance is its flexibility. You can customize your policy by choosing the coverage amount, policy term (for term life), and adding riders such as critical illness, disability income, or accidental death benefits. This ensures the policy meets your unique financial and personal goals.

How do I choose the right amount of coverage?

The right amount of coverage depends on your financial goals, obligations, and the standard of living you wish to secure for your beneficiaries. Consider factors such as income replacement, debt repayment, future education costs for your children, and any other financial needs that would arise in your absence. A financial advisor can help you calculate an appropriate coverage amount based on these considerations.

How does the claims process work for individual life insurance?

In the event of a claim, the beneficiaries or the policyholder (in the case of a living benefit claim) must submit a claim form along with the required documentation, such as the death certificate for a death benefit claim, to the insurance company. The insurer will then review the claim and, if approved, disburse the benefit amount to the beneficiaries. The process is designed to be straightforward, and many insurers offer assistance to guide beneficiaries through the claims process.